The Data Foundation and LexisNexis® Risk Solutions have co-authored a report, Who is Who and What is What? The Need for Universal Entity Identification in the United States. The report outlines the need for the U.S. government to adopt a universal method of entity identification in order to verify companies, nonprofits, and other organizations using a single, common unique identifier. More than 15 government, private sector, and tech experts were interviewed for this report.

The solution to this need already exists: the global Legal Entity Identifier (LEI), which is already used by over 90 government agencies around the world. The LEI is a standard, non-proprietary, verified identification code that is managed by a global, federated system. It already enjoys support from major players in the financial industry.

Implementation of the LEI across all U.S. government reporting would have a range of benefits for industry, governments, watchdogs, and, ultimately, taxpayers. The LEI would create a single electronic view of all legal entities, knit together from their existing government reports - bringing transparency for investors, efficiency for regulatory agencies, and lower costs for the entities.

Contents

Executive Summary

The financial crisis which brought the global economy to its knees in 2008 illuminated a number of crucial, necessary reforms. Some apply specifically to the world’s financial markets, but others represent public goods with wide ranging effects across various sectors of our economy and government.

The need for a global, interoperable method of entity identification was one such reform. With the help of leaders in government, industry, academia, and the nonprofit sector, that need is closer than ever to being fulfilled, thanks to the global Legal Entity Identifier (LEI).

The LEI is a standard, non-proprietary, verified identification code, managed by a global, federated system. It has been adopted by financial regulatory bodies across the world and enjoys support from major players in the financial industry. But it can do so much more. The LEI can, according to one interviewee, be useful wherever a contract exists. [1]

The United States government suffers from a glut of solutions to the entity identification problem. Individual agencies rely on multiple entity identifiers, companies maintain internal IDs, and proprietary ID systems are fatally flawed. Legal entities are often identified by a range of numbers that are siloed by industry, without useful connection to a broader external system. There is no ID to rule them all. The LEI can become that ID.

To more fully understand the need for, and benefits that will flow from, the universal adoption of the LEI across all U.S. government agencies, we spoke to more than 15 people involved in the LEI effort, or working in areas where entity identification presents unique problems and opportunities.

Through these interviews, we identified some of the benefits of the LEI as well as challenges facing its universal adoption and growth, in the U.S. and elsewhere.

If universally adopted, the LEI will connect companies across government and industry. It will be used to evaluate risk in the financial sector, track and debar low performing or corrupt government contractors, understand transactions in energy markets, paint a complete picture of supply chains across various sectors, track grants from the federal government to local recipients, and much, much more.

Given the wide range of uses for a global, interoperable system for entity identification, it might be expected that the problem would have been solved long since. However, numerous challenges remain that have slowed the adoption of the LEI in the United States. Specifically, our interviewees cited cost concerns, technical concerns associated with migrating from existing systems for entity management, a collective action or chicken-and-egg problem, and other cultural concerns.

These concerns are real, but as this paper lays out, they are outweighed by the benefits that will accrue from the universal adoption by the U.S. government of a global, standard, interoperable system for entity identification: specifically, the Legal Entity Identifier.

Why The United States Needs Universal Entity Identification

Our world grows more complex by the minute. The Internet and other digital technologies have eased previously- insurmountable barriers to trade and communication. Business relationships increasingly exist across national borders, spanning multiple regulatory systems and legal frameworks. Financial markets operate at superhuman speeds. Organizations create subsidiaries to operate in new countries, develop new products, work with new partners, and sometimes even to help hide illegal activity or obscure previous activities.

To cut through this complexity, it is vital for businesses, governments, researchers, and more to have a precise understanding of “who is who, who owns whom, and who owns what.” [2] Building a shared understanding of entities and ownership is at the center of a range of economic and governmental activities. In the United States, this shared understanding must be built again and again, in each industry and regime.

Despite attempts by “the vendor community...to provide solutions for these private and public challenges...not one was ever sufficiently robust, comprehensive, or open to serve as an industry-wide standard.” [3] In the United States this has led to a particularly messy situation wherein regulatory and other agencies embrace a wide array of non- interoperable identifiers. While one ID rules the government procurement space -- the DUNS Number -- its proprietary nature has caused a whole host of other problems.

Different, sometimes competing, and rarely interoperable standards exist to tackle the problem in different areas. The financial industry has its own set of identifiers, organizations competing for government grants and contracts have their own set of identifiers, the defense industry has its own set of identifiers, various entrants in the business information services industry have their own identifiers, and so on. These identifiers are siloed by industry and agency. They may be good enough for specific internal purposes, but the lack of a universal “key” frustrates cross-industry connections and insights.

Companies and nonprofits that are regulated by, or do business with, U.S. federal agencies may be identified a wide range of identifiers, or even a combination of several, depending on how they interact with the government. Companies may also be identified by other codes based on their activities at the state, local, and international levels.

A Selection of the Entity Identifiers Currently Used in the United States

These identifiers are siloed, with limited functionality outside of their industry or agency. For example, there is currently no simple way to link the Federal Energy Regulatory Commission’s Form 1 with the Securities and Exchange Commission’s Form 10-K filed by the same company. A common identifier -- or an easy way to map between identifiers – would allow agencies and investors to instantly connect information across these documents.

A universal identifier could save time and money by turning such mapping into a simple task. Further, it would make the data collected and maintained by all agencies more interoperable and powerful.

This existing system, with its hodgepodge of specialized, often proprietary, and narrowly-tailored identifiers, leads to unnecessary private-sector reporting costs, lower data quality, narrow use cases, limited ability to understand risk, and more.

The need is clear for a universal identifier system capable of connecting identities across all industries and agencies. In the wake of the financial crisis, a viable model for universal identification has emerged. It is currently being embraced for uses across the financial sector, but also has applications in public and private procurement, regulatory oversight, payment processing, supply chains in various industries, and any other area where organizations enter into contracts with each other.

The Solution: Universal Adoption of the Legal Entity Identifier

Developed in reaction to the global financial crisis, initially championed by numerous parties within the United States government, and brought to maturity with help from contributors around the world, the global Legal Entity Identifier (LEI) provides the ideal solution to the entity identification challenge faced by governments and commercial interests in the United States.

History and Growth of the Global LEI

The global financial crisis brought the need for a universal entity identification system into stark relief for the financial industry. As reverberations from Lehman Brothers’ failure began to be felt across markets, firms struggled to understand their level of exposure to the growing crisis. Because there was no consistent way to identify particular legal entities, firms often did not understand how much money they owed to and to whom they owed it. They also lacked a clear picture of how much money they were owed by other firms. So did regulators: even though Lehman Brothers’ various entities were reporting to many government agencies around the world, governments seeking to address the crisis found that they could not assemble an electronic picture of markets’ full exposure to Lehman.

For example, Firm A may have a list of 100 transactions with each counterparty appearing to be a different entity, when in fact Firm B was really on the other end of 50 of those transactions. Without a consistent entity ID, there was no way for Firm A to know the extent of its business with Firm B -- and thus its exposure to risk if Firm B became insolvent. If the counterparties had been able to identify each other, they would each be capable of more robust risk assessment and planning. [4] In the most critical moment, this lack of clarity froze credit markets, intensifying the financial crisis. If firms were better able to quantify their risk, they could have gone on extending credit to healthy entities while larger market and regulatory forces isolated and dealt with the companies most at risk of collapse.

Efforts to improve identification systems have been ongoing for decades, but until the crisis had resulted in nothing more than a plethora of competing or internal systems that didn’t fully solve the problem at hand. Following the crisis, the world’s financial regulators -- with an initial push from regulators in the United States -- began to address this collective action problem and call for a common and global entity ID. [5]

Eventually, the Department of the Treasury’s Office of Financial Research (OFR), working with the European Commission and European Central Bank, identified and recruited the G-20 to take on the work of moving forward with the idea of a global entity ID. [6] The G-20 directed the Financial Stability Board (FSB) to build out “recommendations and proposals to implement a global Legal Entity Identifier (LEI) system that will uniquely identify parties to financial transactions.” [7]

In response, the FSB recognized a common ID as “public good” and laid out several specific recommendations to implement and develop a global LEI system. Four are interesting for the purposes of this paper [8]:

Recommendation 5 – System Flexibility

Recommendation 6 – Competition and Anti-trust Considerations

Recommendation 16 – LEI Data Validation

Recommendation 31 – LEI Intellectual Property

The FSB established a governance structure for the new system: a Regulatory Oversight Committee (ROC), Central Operating Unit (later renamed the Global LEI Foundation, or GLEIF), and Local Operating Units (LOU). [9]

The ROC, made up of approximately 90 public-sector authorities, operates as an oversight body for the LEI system, ensuring that it is upheld as a public good, developing policy standards for the system, and overseeing the operation of the GLEIF. [10] The GLEIF oversees the day-to-day operations of the LEI system, ensures that the LEI data pool is freely and publicly available, conducts quality management activities to ensure that LEI data meets clearly defined standards, and works with the LOUs to ensure that they meet accreditation standards. [11] The GLEIF is also committed to open data principles and is an active supporter of the International Open Data Charter. [12] Finally, the LOUs supply registration and renewal services and act as the primary interface for legal entities as they obtain an LEI. [13]

This three-tiered governance structure was recommended by the FSB in order to create “a strong global governance framework to protect the public interest, while promoting an open, flexible, and adaptable operational model for the global LEI system.” It also reflects the FSB’s recommendation of a global system supporting “a high degree of federation and extensive reliance on local implementation under agreed and commonly applied global standards. In particular, the global LEI system should be designed, operated and governed in a manner that ensures unique entity identification and consistency at the global level, while drawing on distributed local elements and local infrastructures where possible.” [14]

That recommendation is reflected in the structure of the LOUs. Any entity can apply to become an LOU and, after it meets certain accreditation standards, be empowered to issue LEIs to legal entities. [15] Entities that are required to obtain an LEI can obtain it from any LOU they like, seeking out the ideal LOU based on cost, familiarity, or other criteria. Other identifiers do not offer such flexibility.

The first regulatory agencies were adopting the LEI before the long term governance structure was even put in place. The Commodities Futures Trading Commission (CFTC), along with the European Securities and Market Authority (ESMA), provided the “practical birth of the GLEIS [when they required] counterparties to over-the-counter derivatives trades to register for and report an LEI.” [16] The CFTC helped clear a path forward for agencies thinking about embracing the LEI. Instead of becoming an LOU itself, the CFTC worked with DTCC-SWIFT’s Global Markets Entity Identifier (GMEI) utility, the first organization serving the United States LEI market to become an accredited LOU. [17]

As envisioned by the FSB, competition in the space continues to grow, ensuring that entities needing to register for an LEI have options. Recently, an LEI issuing service run by Bloomberg became athe second LOU in the United States. [18] This will be discussed further in section 4 of this paper, but it is worth noting here that the entry of this new player in the US market has already helped to drive the price of an LEI down significantly.

Since then, a number of agencies in the United States and around the world have mandated that entities they regulate obtain an LEI. To date, over 500,000 entities around the world have registered for an LEI, a number that is expected to climb next year when two regulations -- the Markets and Financial Instruments Directive II (MiFID II) and the Regulation on Markets in Financial Instruments (MiFIR) -- go into effect in Europe. [19] Those regulations will require, among other things, that all participants in trades conducted in the European Union obtain an LEI. This will ensure that investment firms, their clients, and issuers of any traded instruments in the EU -- including equity securities -- obtain an LEI. [20]

Adoption of the LEI in the United States

Since the CFTC became the first US regulator to mandate use of the LEI, a number of other regulators in the United States have embraced the LEI for a variety of uses.

So far, most of these agencies have been involved in the financial services industry. However, several proposed and final rules requiring the LEI show its applicability to a range of other sectors, including energy markets and the home mortgage industry.

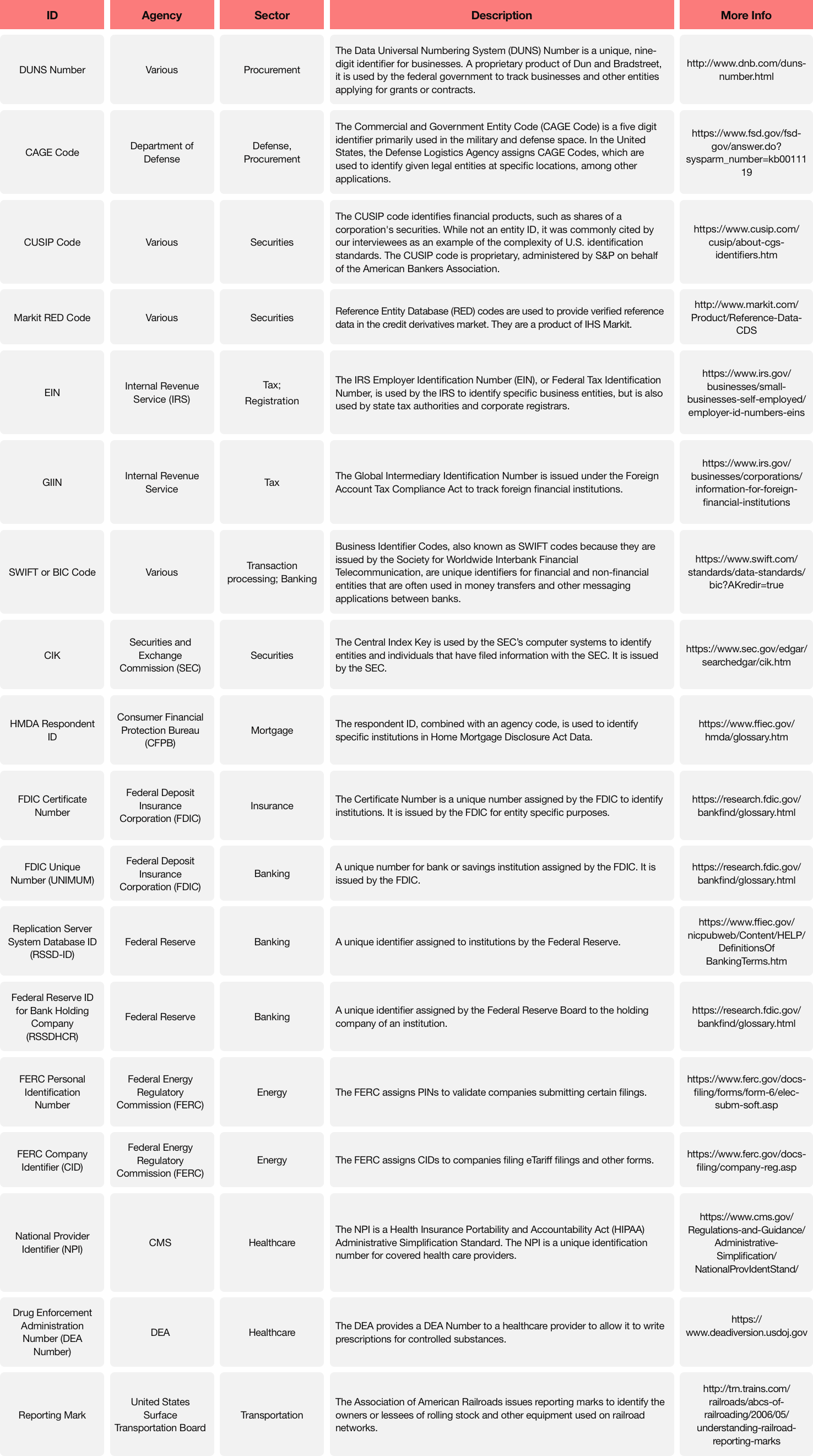

The charts below, prepared by the GLEIF, detail required uses of the LEI in approved or proposed regulatory rules.

Among the U.S. regulators adopting, or considering, the LEI, three are representative: the Commodity Futures Trading Commission, the Consumer Financial Protection Bureau, and the Federal Energy Regulatory Commission.

Approved Regulations Requiring the LEI [21]

Proposed Regulations Requiring the LEI [22]

Commodity Futures Trading Commission

As discussed above, the CFTC helped birth the Global LEI System when it required “counterparties to over-the-counter derivatives trades to register for and report an LEI.” [23]

The CFTC became involved in the LEI effort early on after seeing the need for a consistent way to identify swaps counterparties during the financial crisis. The LEI was an ideal solution to the CFTC’s specific problem because of the global reach of the identifier and the global nature of the market that it regulates, with trades bouncing from the US to the EU to Japan and beyond. Swaps transactions don’t go through a specific exchange, but are instead traded on a bilateral, over-the-counter basis, making it difficult to track ultimate ownership without a consistent, global ID. [24]

So far, the CFTC has implemented two rules requiring regulated entities to obtain an LEI: the Swap Data Record Keeping and Reporting Rule (Parts 45 and 46) [25] and 17 CFR Parts 3, 32, and 33 on Commodity Options. [26]

Consumer Financial Protection Bureau

The Dodd-Frank Financial Reform and Consumer Protection Act transferred authority to make rules under the Home Mortgage Disclosure Act (HMDA) from the Federal Reserve Board to the Consumer Financial Protection Bureau (CFPB). [27] Beginning in 2018, entities regulated by the CFPB under HMDA Regulation C will be required to obtain and report an LEI. [28]

The LEI will be useful to the CFPB in several ways. First, it will bring more consistency to data collected under HMDA. When HMDA was administered by the Federal Reserve Board, there was no overarching ID assigned to every loan issuing entity. Eventually a Respondent Identification Number (RID) was issued, but it could change every year, resulting in numerous numbers linking back to individual organizations. The LEI should impose consistency, making it easier to track loan-issuing organizations over time. [29]

Additionally, the LEI will be used as part of another identifier under development, a Universal Loan Identifier (ULI). Traditionally, banks had been able to identify loans in any way they wanted, leading to significant issues if loans moved between banks. The ULI will make it much easier to understand where a loan originated as it is sold and moved. [30]

Federal Energy Regulatory Commission

The Federal Energy Regulatory Commission (FERC) has not yet mandated the use of the LEI, but it is considering doing so as part of 18 CFR Part 35 which applies to the collection of entity data from regional transmission organizations and independent system operators. [31]

Currently, FERC has at least three different systems to track entities. They range from relatively sophisticated (an internal identification number) to outdated (pulling names out of PDFs and matching by hand). The agency was drawn to consider the LEI because of the similarities between the energy markets that it regulates and the financial markets where the LEI has been used most often. The LEI appeared to be a good fit because it outsources much of the technical work, provides a connection to other sectors and countries, and could serve as a bridge for existing internal systems.

Comparing the LEI to the hodgepodge of U.S. entity identifiers

Thanks to the early groundwork laid by the FSB, regulators in the United States, and the G-20, the LEI has several features that set it apart from all the other entity identifiers in use in the United States. It is global, it is non-proprietary, it is federated, and it is verified at several levels, ensuring high data quality, and it is federated

Global and Non-Proprietary

The global financial crisis helped highlight the need for a global solution to entity identification problems. “Without a basic ability to identify financial market participants and their corporate families, firms and the regulators supervising them would continue to struggle to understand the links and exposures throughout the global financial infrastructure.” [32] Similar problems extend to any sector operating across the globe. A global identifier will also ease international commercial information sharing, “making it easier to conduct oversight on firms that exist across borders...[enabling] better supervision of cross-border firms and firms whose business lines are overseen by multiple regulators.” [33]

If regulators across the globe were to mandate the use of a single ID service provided by a vendor, a monopoly would be created, with a risk that the owner of the ID might take advantage of its position to overcharge, restrict access, and skimp on data quality. [34] This has happened already within U.S. government procurement. In the United States, Dun & Bradstreet, Inc., has an effective monopoly on entity identification services in procurement, because the federal government requires every grantee and contractor to register for Dun & Bradstreet’s DUNS Number. This has led to higher costs for the federal government, limited data access for agencies and the public, and even a reduced ability to introduce new competition into the market for identification services. [35]

In fact, as part of ongoing efforts to re-evaluate how the U.S. government handles entity identification in the procurement space, the General Services Administration (GSA) has decided that “it is not in the best interests of the government to change from one proprietary number to another.” [36] Any future changes will be to a non-proprietary or government owned system. [37]

The LEI avoids this problem in several ways. First, the LEI is an acknowledged public good and the ROC and GLEIF were specifically set up to work in the public interest, not for profit. Second, the LEI system is set up using a non-profit cost recovery model and service providers are restricted from taking commercial advantage of their position. [38] Finally, the LEI is non-proprietary, with its supporting structures and associated data managed in accordance with the principles of open data.

The specter -- and reality -- of monopoly provides the best argument against a proprietary system of entity identification. The downsides of monopoly are already clear in the case of the DUNS number in the United States.

Concerns about the potential for monopoly practices were addressed during the initial conception of the LEI system. [39] Its ultimate structure, based on a federated, non-profit cost recovery model, reflects those concerns.

Publishing open data also provides a boost to data quality because it allows anyone interested to review and the system for errors and submit fixes. [40] This is a notable contrast to proprietary systems, whose data sometimes aren’t even available via Freedom of Information laws. [41]

Verified

The ability to verify information and ensure high quality data is a key component of any entity ID system. In fact, up to 80 percent of GSA’s contract with Dun & Bradstreet is earmarked for business verification and corporate linkage information and services. [42] In the private sector, businesses spend untold sums on data validation and cleaning.

The LEI system provides validation services at registration and has a robust data quality management program in place. Validation is performed by the LOUs when issuing LEIs to legal entities. Registering entities provide certain information to the LOU which then validates it against a local authoritative source. The GLEIF can perform further validation and quality checks up the chain. [43] The GLEIF has strong agreements in place with the LOUs to ensure service levels and quality standards. [44]

Federated

The global LEI system consists of the ROC, the GLEIF, and LOUs around the world. Any government agency can choose to rquire its regulated entities or contractors to register and receive an LEI. This federated system allows for strong technical management, independent oversight, and flexibility to deal with local legal and political contexts.

Any entity that meets certain criteria can work with the GLEIF to become an LOU. Any company that needs to obtain an LEI can then work with any LOU they choose. While initiated in the financial industry, the system was built with the flexibility to be used in any industry or context that requires entities to be tracked. Unlike many of the entity identifiers currently used in the United States, the LEI is not focused on one specific agency, sector, or geographic area. Federation makes the LEI much more flexible and adaptable.

Benefits of Universal Adoption in the United States

The global LEI is unique in its scope, openness, and verification. For these reasons alone, it is well suited to serve as the single, standard entity ID across all industry and sectors, not just for the financial industry.

Numerous use cases show the benefits of interoperable entity identification. Some are more generally applicable, while others prove that the global LEI system is the only way to meet modern challenges.

If the United States embraces a single, overarching system for entity identification, the benefits will include savings tied to simplified entity matching tasks, improved risk management in a variety of sectors, more robust government oversight, increased automation, reduced regulatory compliance costs, and much more.

Easier data cleaning and entity matching

Currently, there is little to no standardization in the way that entities are identified across jurisdictions, organizations, or systems. Organizations spend huge amounts of time and money cleaning and matching data to ensure that they know who they are dealing with. Each such project duplicates the efforts of others.

Some see data cleaning and entity matching as the “killer application” of the LEI. If a company’s master customer list has 1,000 entities, say, the company must spend time and money figuring out how many are duplicates. The LEI could make this task instantaneous and nearly free. [45]

Most financial companies have a client database and a securities master database. Linking securities to issuing entities used to be done by hand, but having a reliable, globally interoperable entity ID like the LEI can automate this task, saving time and money.

For example, a bank -- Let’s call it AnyBank -- could be listed in various ways within a single data system. AnyBank could also appear as Any, anybank, AnyBank na, AnyBank n.a., Any na, etc.

Cleaning up the data for AnyBank company could take 15 minutes by hand, but be completed instantaneously with the help of the LEI. Extrapolating this savings across the entire financial industry shows that the potential becomes immense.

This scenario is not mere speculation. The LEI is already being used to save millions of dollars at one financial company through time saved on data linking and quality across databases. These applications don’t just apply to financial companies, but will save money and time across sectors of the economy and government. [46]

Data cleaning and entity matching are not just an internal problem. They reach into every sector and have worldwide ramifications in our increasingly interconnected world. Individual companies, government agencies, or even entire countries may have their own, internal solutions for entity identification and matching, but those solutions are sorely lacking as soon as an international context is considered. Without a global standard, companies and regulators will encounter the same challenges each time they expand. [47]

More robust risk management

As discussed earlier, the initial push for the global LEI project came out of the global financial crisis. As the crisis spread, firms often did not understand how much money they owed to or to whom they owed it. They also lacked a clear picture of how much money they were owed by other firms. In the most critical moment, this lack of clarity froze credit markets and helped plunge the global economy into chaos.

Put another way, “without a basic ability to identify financial market participants and their corporate families, firms and the regulators supervising them would continue to struggle to understand the links and exposures throughout the global financial infrastructure. This deficiency would continue to weaken market discipline and risk management, and threaten orderly resolution of failing firms.” [48]

What does this look like in practice? At the height of the crisis, Lehman Brothers was, legally speaking, an amalgamation of 7,000 different entities spread across the globe. [49] It is possible that even Lehman Brothers itself didn’t understand its own complicated corporate structure.

Consistent entity identification would allow regulators and companies to better understand global corporate hierarchies and assess risk in various areas of the global economy.

This is not simply a benefit for the financial sector, but has applications in logistics, government procurement, and more.

For example, after the 1989 Exxon Valdez oil spill, none of the affected re-insurance providers understood their risk exposure because of opacity in the supply chain. A global entity ID would have given them a much better understanding of the underlying entities in their risk pool. This concept could apply to any asset backed security. [50]

Better risk management should also help build trust in areas that may currently be considered risky. For example, many banks have pulled out of fragile states, disconnecting them from global financial streams and pushing them closer to the edge. If the LEI is required for correspondent banking, it could eventually help these countries reconnect with and regain trust from the global financial system. [51]

Embracing the LEI may also help the United States make progress on longstanding law enforcement priorities that are made more difficult by complicated corporate structures and money laundering schemes, including terrorism financing, drug trafficking, and tax inversion.

Reduced regulatory compliance burden

As explained earlier in this paper, the U.S. government currently relies on a wide hodgepodge of entity identifiers that often vary between, or even within, agencies. Companies may be identified by any number of different IDs, depending on how they interact with the government. The current chaos contributes to high costs for both agencies and companies. Embracing a global ID like the LEI could help regulators and their regulated entities simplify reporting. [52]

Agencies could still use their existing IDs for internal purposes, but applying the LEI alongside existing ones would allow them to better understand how their regulated entities interact with other areas of the government. For example, right now there may be economists at the SEC and the Federal Reserve Board looking into similar questions affecting the same company, but since the two bodies use different identifiers a gap in understanding exists that is difficult to surmount without an easy way to map between each agency’s data. [53] The LEI could also make life easier for companies that want to do business with the government, allowing them to interact with various agencies using the same LEI.

Improved oversight and consumer protection

A single, interoperable entity identifier would allow watchdogs to conduct more robust oversight across a variety of sectors and applications.

The federal government is constantly working to ensure that it is spending its money wisely, sending payment to the right organizations, and not continually relying on entities that are not trustworthy. In 2011 the Department of the Treasury developed the Do Not Pay Business Center (DNP) “to support federal agencies in their efforts to reduce the number of improper payments made through programs funded by the federal government.” [54] The DNP provides data, tools, strategy, and service to agencies to help them “mitigate and eliminate improper payments in a cost-effective manner while safeguarding the privacy of individuals.” [55]

The key underpinnings of the DNP center around effective, consistent identification of entities in mutually exclusive databases for the purposes of matching payment data submitted from various federal agencies. The presence of the LEI could alleviate many challenges currently faced by the DNP due to data formats, typos, or wrongdoing by entities requesting paymentsfromtheFederalgovernment. IftheLEIwereusedas a single identifier across the federal government, then the DNP would easily ferret out payments that should be stopped, without repercussions from stopping a payment to the wrong entity.

Entity identifiers are also integral to the federal governent’s effort to share information on government spending with the public via the USASpending.gov platform. Currently, these federal spending transparency initiatives rely on the proprietary DUNS Number for entity identification, significantly limiting the data’s flexibility and usefulness as a public accountability tool. [56]

The LEI will be a powerful oversight tool in areas well beyond the federal spending space. As discussed earlier, it is already improving transparency and lowering risk in a range of swaps- related applications and will soon be doing the same for home mortgages. As described earlier in this paper, the Consumer Financial Protection Bureau, created in the wake of the financial crisis, was given authority over the Home Mortgage Disclosure Act (HMDA). In 2018, the LEI will be added to the data collected under HMDA.

HMDA data is eventually aggregated in a number of ways that can be used to perform oversight and test risk in the overall market, and the LEI will play an important role, helping improve understanding of where mortgage issuers are exposed to greater risk. Furthermore, LEIs are being used as part of the Uniform Loan Identifier (ULI). Described in detail in section 2 of this paper, the ULI will allow individual loans to be tracked as they are bought and sold as derivatives, providing a new level of transparency to market participants, regulators, and individual loanholders. [57]

Outside of the United States, the LEI is being used to provide greater transparency and protection for consumers in a variety of contexts. For example, the European Prospectus Directive would require the LEI of the issuer of a security to be clearly published in the prospectus for that security. Often it is hard to tell what the ultimate entity behind a security is; this reform would give more power to consumers by identifying the chain of command behind a given security. [58]

Supply chain management

The LEI will be useful if integrated into existing supply chain management data systems, providing an additional layer of understanding. The GLEIF is currently working with GS1, the global organization that issues barcodes, to integrate LEI data. Ultimately, a connection between the two IDs could improve supply chain transparency by tracking the entities that products interact with as they flow throughout their entire lifecycle (from producer to wholesaler, shipper, retailer, etc.). [59] Supply chain transparency could reduce costs and create new business models positive effects in any product-based industry.

Integration with barcode technology could be very powerful. But even on its own, the LEI could have powerful effects on the supply chain in industries that don’t currently use barcodes.

Challenges to Universal LEI Adoption

Despite the benefits outlined above, and after an initial burst of energy, adoption of the LEI in the United States has slowed down. Only slightly more than 1 rule has been adopted per year since the CFTC’s initial move to require the LEI in 2012. Meanwhile, a number of agencies have passed rules suggesting the use of the LEI or allowing entities to report their LEI if they wish to, but have appeared hesitant to mandate its adoption. [60] This slowdown highlights several factors challenging the success of the LEI (or any other global entity ID).

While the global LEI has grown since its initial conception less than a decade ago, a number of challenges still stand in the way of its universal adoption, especially in the United States. The LEI’s cost model puts the onus on individual entities to register and pay renewal fees. The fact that many organizations already have their own internal entity IDs or are assigned entity IDs by a regulating body may make them hesitant to embrace a new system. Additionally, some organizations may balk at potential costs associated with migrating to a new system. Finally, a number of our interviewees discussed a collective action or chicken-and-egg problem, wherein legal entities are hesitant to embrace the LEI until they are instructed to do so by a regulator, while regulators are hesitant to impose change on the entities that they regulate. This problem has been particularly notable in the United States and may contribute to the relatively slow adoption here.

Costs

Most identifiers’ costs are covered by taxpayers, industry, specific user fees, or a proprietary interest in the resulting data sets. The LEI takes a somewhat unique approach to cost. The LOUs, GLEIF, and ROC operate on a non-profit cost recovery model that requires legal entities to pay a fee to register and renew their LEIs. Each individual LOU can charge two fees. The first is discretionary while the second is set by the GLEIF and goes to support the functions and activities of the GLEIF and ROC. [61] The fee set by the GLEIF is currently $19, but is expected to drop steadily as the system continues to grow. [62] Meanwhile, the discretionary fee is set by LOUs and has already shown sensitivity to market factors such as increased competition.

While costs are expected to fall to minimal amounts, registering for or renewing an LEI currently costs in the low hundreds of dollars. For example, the GMEI Utility, a DTCC company — until recently the only major LOU focused on the U.S. Market — charges a discretionary fee of $100 (not including the $19 GLEIF fee), followed by $80 annually for renewal. [63] Prices are expected to continue falling, but if they don’t these costs could prove difficult for small organizations as well as large ones with many legal entities under their corporate umbrellas.

Change management and leadership

Many organizations -- whether in industry or government -- see the logic in a global entity ID, but are hesitant to change their processes or systems to accommodate a new ID or move on from their existing, often siloed or proprietary IDs. Sometimes this is a matter of culture, but there are also legal barriers to this sort of change. For example, until recently in the United States the Federal Acquisition Regulation (FAR) contained specific language requiring organizations wishing to do business with the federal government to acquire a DUNS number. [64] This gave Dun & Bradstreet a formal, legal monopoly and made the prospect of switching to an alternative ID system legally daunting. [65] Late in 2015, the language was amended to remove the specific reference to DUNS, a first step towards embracing a more open system. [66] But this legal change did not affect the de facto reality that all federal agencies use the DUNS Number to track their grantees and contractors.

Further, professionals in every industry and sector are accustomed to working with their current identifiers. No industry or sector is inclined to embrace a new system just for the sake of change. Instead they need strong leadership to move forward. [67]

Migration

Organizations already have identifiers embedded into their internal systems and processes. Migrating these to a new ID could be costly and time consuming. Several interviewees noted that organizations may be hesitant to migrate completely away from their existing entity identification systems, but more open to using the LEI as a bridge to connect multiple systems. [68]

One interviewee explained that, as it currently stands, the LEI won’t offer much of advantage over certain current systems because some mapping challenges have already been solved. However, the same interviewee cited the future flexibility of the LEI -- specifically the GLEIF’s plans to incorporate more hierarchical information -- as a game-changer that will make the LEI more useful in the long run. [69]

Uptake (the “chicken-or-egg” problem)

Several interviewees identified a chicken-or-egg problem concerning uptake of the LEI. Entities are hesitant to register for an LEI unless they are instructed to by a regulator. Meanwhile, regulators are hesitant to mandate the use of LEI because they are concerned about the potential costs or technical challenges in implementation or think that their regulated industries are not interested in the system.

This is potentially one of the most significant challenges to broader adoption of the LEI. As adoption grows demand for the LEI will grow in kind, but until some critical mass is met, regulatory bodies and their regulatory entities will be jointly hesitant to fully embrace the LEI. [70]

Meeting the Challenges

Costs

A number of the individuals we interviewed believed that cost concerns would rapidly diminish as more competition entered the LOU market. In fact, competition has already proved to be effective in driving costs down. Bloomberg recently entered the market in the United States at a significantly lower price point than the incumbent LOU: a $75 discretionary fee for initial registration and $50 for renewal. [71] In response, the incumbent lowered its discretionary fee from $200 to $100. The entrant of one new competitor to the market led to a 50% price cut, and there is no reason to believe that it won’t continue to drop until it hits the single digits. [72]

Additionally, costs tied to building and maintaining the broader LEI system are expected to drop as the system matures. Less money will have to be spent on building technology, setting up structures, and dealing with initial legal considerations.

Representatives of large financial institutions have been supportive of the LEI in part because of its ability to reduce data management costs across the financial sector. [73] The Securities Industry and Financial Markets Association has been supportive of efforts to boost the LEI, specifically citing its ability to boost efficiencies. [74] Once firms understand the broader value of the LEI to reduce other costs, comparatively small registration fees should not create much of a roadblock to adoption.

Change management

In order to achieve the potential benefits of a broadly accepted and used entity ID like the LEI, strong leadership is required. As mentioned previously, specialists in entity matching within specific industries and agencies are likely too accustomed to their silos to move strongly towards change. Leadership must instead come from other sources.

Policymakers in Congress and the White House can and should provide that leadership. They have the ability to look across sectors to understand the positive network effect of a globally interoperable entity identifier.

Migration

Experts that we interviewed acknowledged that migration is a technical hurdle, but they were clear that there was nothing unique or challenging about LEI implementation. [75] Instead they viewed it as a capital improvement cost with a likely high return on investment. It is possible that migration issues will pose a larger problem for cash-strapped government agencies or small industry players.

For cost-sensitive entities, migration should not necessarily be seen as a near-term problem. In the short term, the LEI can be implemented alongside other existing systems. Those outdated, proprietary, or siloed systems can be phased out over time as budgets allow. [76] In the meantime, the LEI can serve as a bridge between other, pre-existing identification systems and across industries, sectors, agencies, and borders.

In fact, a number of interviewees indicated that most entities would not abandon their own internal identifiers, but could welcome a globally accepted identifier alongside them -- perhaps the LEI -- because of its ability to ease mapping tasks and bring together various sectors and applications in new, powerful ways. [77] Specifically, many agencies rely on internal identifiers that aren’t used anywhere else, making it less likely that they will connect their internal data with any potentially useful outside data sources. [78] A globally- relevant ID like the LEI would allow these agencies to fully leverage their own data by more easily mapping it to other data sources.

Uptake / “chicken or egg”

This might be the hardest hurdle to clear, but there are several possible ways forward. First, it is important to identify potential “killer applications” for the LEI. If these hyper-useful applications are identified and shared, organizations will be inspired to buy into the LEI system without regulatory compulsion. [79]

We hope that this paper can shed light on some of those killer applications, but in the meantime it will remain important for regulators to continue to consider and require the LEI in order to boost participation.

Education will also be key. For example, the LEI’s open, federated model has ensured much better data quality than any of the existing, proprietary solutions. Market participants and regulators need to be made aware of this and other benefits of the LEI before they decide to buy in-to the system. [80]

Conclusion

A global system for trustworthy, interoperable entity identification will have a range of benefits for industry, governments, watchdogs, and ultimately taxpayers. It will reduce risk in our financial system, help root out waste and fraud in government procurement, save business money through automated compliance and increased data quality, and improve the quality of insights provided by business intelligence firms, journalists, researchers, watchdogs, and more.

The LEI is that system. It is global, and gaining momentum globally every day. It is non-proprietary, and its foundation is built on open data principles. Its data is verified and of high quality. It is flexible and adaptable to a range of uses, some of which haven’t even been conceived yet.

Congress and the White House should mandate a government-wide move to adopt the LEI universally, across all the U.S. government’s regulatory and reporting operations.

Appendix: Interviews

Srinivas Bangarbale, Commodity Futures Trading Commission

Andrea Brandon, Department of Health and Human Services

Robin Doyle, J.P. Morgan

Karl Eiholzer, Municipal Securities Rulemaking Board

Danny Goroff, Sloan Foundation

Ed Kelly, State of Texas

Ben Lis, LEI Smart

Michael Peckham, Department of Health and Human Services

Linda Powell, Consumer Financial Protection Bureau

Ren Essene, Consumer Financial Protection Bureau

Matthew Reed, Office of Financial Research, Department of the Treasury

Clare Rowley, Global LEI Foundation

Robert Surber, State of Michigan

Jim Swift, Cortera

Chris Taggart, OpenCorporates

Mike Willis, Securities and Exchange Commission

Stephan Wolfe, Global LEI Foundation

About the Authors

Scott M. Straub – Director of Federal Market Strategy, LexisNexis Risk Solutions

Scott is the Director of Federal Market Strategy at LexisNexis Risk Solutions and is responsible for developing data driven solutions for governments in their fraud, waste and abuse prevention processes. Scott has invented several identity based solutions using LexisNexis’s vast public record database and holds patents in these solutions designed to assist governments in preventing fraud, reducing improper payments and collecting delinquent receivables.

Scott has been a frequent speaker on a variety of topics since joining LexisNexis in 2011, including testifying on government debt collection best practices to the Legislature in the state of Louisiana and participated on a panel discussion regarding government efficiencies at the Democratic Governors Association. Scott is also on the Advisory Council for the International Association of Financial Crimes Investigators and the Board of Advisors of the Data Coalition.

Prior to joining LexisNexis Risk Solutions, Scott was employed at the Financial Management Service (FMS), a bureau of the US Treasury where he drafted strategic plans for multiple business units, implemented industry best practices in the collection processes of delinquent debt owed to the federal government by creating an analytics division to streamline collections strategies through combining internal and external data and was a project manager on an internal control review project, whose outcomes were designed to prevent fraud against the government. Also, while at FMS he coauthored a feasibility study to repurpose a payment center to a debt collection center and worked with the Office of Management and Budget to pass several initiatives through Congress to maximize efficiencies in the debt collection process.

Scott holds a masters in finance and a graduate certificate in investments from the Carey Business School at Johns Hopkins University.

Matt Rumsey – Independent Researcher

Matt is a consultant, researcher, and advocate with expertise in open data and transparency policy. He has done work for organizations including the Center for Open Data Enterprise, the Sunlight Foundation, and the Data Foundation. Previously, he managed the Sunlight Foundation's federal level policy initiatives as senior policy analyst. He is a graduate of the American University in Washington, D.C. and currently resides in Paris, France.

Copyright © 2017 Data Foundation. All rights reserved.

Copyright © 2017 LexisNexis® Risk Solutions All rights reserved.

This document contains general information only and LexisNexis® Risk Solutions and The Data Foundation are not, by means of this document, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This document is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor.

LexisNexis® Risk Solutions and the Data Foundation shall not be responsible for any loss sustained by any person who relies on this document.

Interview with Chris Taggart. ↩

Collective Action: Towards Solving a Vexing Problem to Build a Global Infrastructure for Financial Information, John A. Bottega and Linda F. Powell, 2010, 17. ↩

Creating a Linchpin for Financial Data: The Need for a Legal Entity Identifier, Bertrand Couillault, Jun Mizuguchi, and Matthew Reed, Office of Financial Research, February 2017, 1. ↩

Interview with Srinivas Bangarbale. ↩

Couillault, Mizuguchi, Reed, 1; see also Bottega and Powell; see also Office of Financial Research, U.S. Department of the Treasury, Statement on Legal Entity Identification for Financial Contracts, Statement of policy, 75 Federal Register 229, Nov. 30, 2010. ↩

Interview with Matthew Reed. ↩

A Global LEI for Financial Markets, Financial Stability Board, June 8, 2012, 1. ↩

A Global LEI for Financial Markets, Financial Stability Board, June 8, 2012, 9-15. ↩

A Global LEI for Financial Markets, Financial Stability Board, June 8, 2012, 4-5. ↩

See About LEI ROC (accessed August 7, 2017). ↩

See This is GLEIF (accessed August 7, 2017). ↩

See This is GLEIF (accessed August 7, 2017). ↩

“A Global LEI for Financial Markets”, 4-5. ↩

See This is GLEIF (accessed August 7, 2017). ↩

Identity, Identification, and Identifiers: The Global Legal Entity Identifier System, Arthur B. Kennickell, Federal Reserve Board, Washington, DC, 2016. ↩

Endorsed Pre-LOUs of the Interim Global Legal Entity Identifier System, LEI Regulatory Oversight Committee, (accessed August 7, 2017). ↩

See About Bloomberg LEI (accessed August 7, 2017). ↩

See European Securities and Markets Authority, MIFID (II) and MIFIR (accessed August 7, 2017). ↩

GLEIF Publishes Annual Report 2016, (accessed August 7, 2017). ↩

See Regulatory Use of the LEI (accessed August 7, 2017). ↩

See Regulatory Use of the LEI (accessed August 7, 2017). ↩

Kennickell, 17. ↩

Interview with Srinivas Bangarbale. ↩

Federal Register / Vol. 77, No. 82 Friday, April 27, 2012 / Rules and Regulations. ↩

About HMDA(accessed August 7, 2017). ↩

Federal Register / Vol. 80, No. 208 Wednesday, October 28, 2015 / Rules and Regulations, (accessed August 7, 2017). ↩

Interview with Linda Powell and Ren Essene. ↩

Interview with Linda Powell and Ren Essene. ↩

See, e.g., Federal Energy Regulatory Commission Notice of Proposed Rulemaking, Data Collection for Analytics and Surveillance and Market-Based Rate Purposes , July 21, 2016, (accessed August 7, 2017). ↩

Couillault, Mizuguchi, Reed, 1. ↩

Financial Stability Board, 26. ↩

Financial Stability Board, 29. ↩

See Government is Analyzing Alternatives for Contractor Identification Numbers, Government Accountability Office, 2012; see also Hudson Hollister to Jason Chaffetz, April 20, 2017 (Responses to Questions for the Record from March 23, 2017, Committee Hearing Titled “Legislative Proposals for Fostering Transparency”). ↩

GAO, 2. ↩

GAO, 11. ↩

Financial Stability Board, 2, 5. ↩

Financial Stability Board, 5. ↩

Kennickell, 15. ↩

GAO, 2. ↩

Kennickell, 15. ↩

GLEIF Annual Report, 15. ↩

Kennickell, 15. ↩

Interview with Mike Willis. ↩

Interviews with Robin Doyle, Jim Swift, Ben Lis. ↩

Interview with Mike Willis. ↩

Couillault, Mizuguchi, Reed, 1. ↩

Guihot, M., Cross-Border Insolvency: A Case for a Transaction Cost Economics Analysis , 2016, 5. ↩

Interview with Mike Willis. ↩

Interview with Stephan Wolf and Clare Rowley. ↩

Interview with Karl Eiholzer. ↩

Interview with Karl Eiholzer. ↩

See Do Not Pay Business Center (accessed August 7, 2017). ↩

See Do Not Pay Business Center (accessed August 7, 2017). ↩

See Matt Rumsey, Recovery.gov dumps DUNS, highlighting need for open entity IDs, The Sunlight Foundation, Sept 10, 2014 and Hudson Hollister, To fix federal procurement, dump the DUNS number, The Hill, December 6, 2016. ↩

Interview with Lisa Powell and Ren Essene. ↩

Interview with Stephen Wolf and Clare Rowley. ↩

Interview with Stephan Wolf and Clare Rowley. ↩

See Regulatory Use of the LEI (accessed August 7, 2017); see also interviews with Karl Eiholzer, Matt Reed. ↩

Financial Stability Board, 5. ↩

GLEIF Annual Report, 19. ↩

See GMEI Utility Pricing (accessed August 7, 2017). ↩

See Unique Identification of Entities Receiving Federal Awards (proposed rule), November 18, 2015; Unique Identification of Entities Receiving Federal Awards (final rule), October 31. ↩

GAO Report. ↩

See note 66. ↩

Interview with Chris Taggart. ↩

Interview with Jim Swift. ↩

Interview with Karl Eiholzer. ↩

Interview with Srinivas Bangarbale. ↩

See Legal Entity Identifier (LEI) FAQs (accessed August 7, 2017). ↩

Interview with Chris Taggart. ↩

Kennickell, 18-19. ↩

SIFMA, Statement on the OFR Accountability Act, October 9, 2015; see also Letter from Kenneth Bentsen, Jr., to Jacob Lew, April 11, 2014. ↩

Interview with Robin Doyle. ↩

Interview with Mike Willis. ↩

Interview with Jim Swift. ↩

Interview with Mike Willis. ↩

Interview with Karl Eiholzer. ↩

Interview with Chris Taggart. ↩

![Approved Regulations Requiring the LEI [22].png](https://images.squarespace-cdn.com/content/v1/56534df0e4b0c2babdb6644d/1504725973635-54FZZGDGVBY8CW41D3OJ/Approved+Regulations+Requiring+the+LEI+%5B22%5D.png)